Welcome to Day Four of the Great American Government Shutdown! Grab your popcorn, folks, because it’s a real nail-biter-except this time, there’s no thrilling climax, just a lot of politicians squabbling over funding for Homeland Security like kids fighting over the last slice of pizza.

The Drama Unfolds: Traders Get Their Crystal Balls Out

Our charming little shutdown saga kicked off at 12:01 a.m. EST on January 31, when Congress, in a stunning plot twist, forgot to pass funding for six appropriations bills. You know, small details like immigration reforms and spending levels that really get the party started.

After the record-breaking 43-day shutdown of late 2025-which was clearly not a bestseller with lawmakers-there’s a collective sigh of “Please, not again!” Essential services are still plodding along, but about 800,000 federal workers are either on an involuntary vacation or working for free, while agencies like the FAA and parts of State Department are already feeling the squeeze. What a time to be alive!

In this riveting backdrop, traders on Polymarket and Kalshi are not betting on who will win the next election but rather on how quickly this circus will wrap up. Spoiler alert: they’re not convinced it’s going to be a long show.

Polymarket: High Stakes, Low Tolerance

Polymarket is seeing shutdown duration bets that have skyrocketed past $18 million, making it the hottest political contract of the year-like the latest must-see reality show, but with more red tape and less drama. Despite all this action, traders are betting lawmakers will find a resolution faster than you can say “gridlock.”

As of 11:30 a.m. EST on February 3, the most popular guess is that this shutdown will last at least five days, with odds hovering around 13%. After that, it’s all downhill: six or more days drop to about 3%, and the longer it goes, the slimmer the chances. If you’re hoping for a 60-day shutdown, well, you might as well buy a lottery ticket instead.

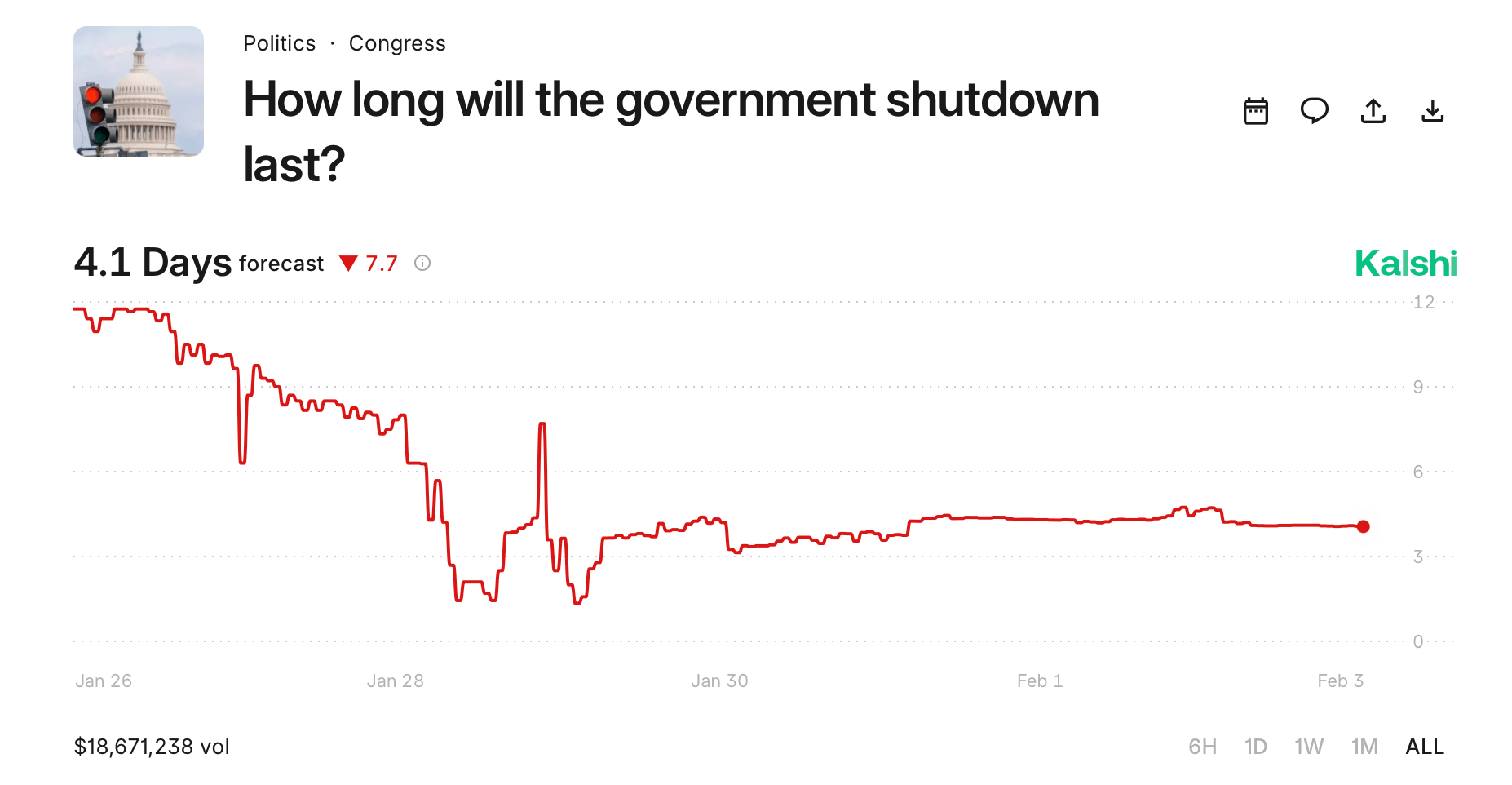

Kalshi Sings the Same Tune

Kalshi has its own shutdown market, asking whether this mess will last more than four days. And guess what? They’ve also reached over $18.4 million in volume, with the “Yes” bet sitting at around 10 cents (practically a steal) and “No” chilling at 91 cents. Sounds like a deal, right?

Because Kalshi makes decisions based on the official Office of Personnel Management updates, traders are laser-focused on what Congress is doing right now instead of worrying about abstract political doom. Can we say pressure?

Why Markets Are Feeling Optimistic (or Just Wishful)

Traders seem to be taking a few things into account: the PR disaster from the 2025 shutdown, pressure from the unpaid workers (who might be getting really creative with their ramen recipes), potential flight chaos, and a House majority so narrow it makes a tightrope walker look stable.

With a key House vote coming up and leaders strutting around with confidence, prediction markets are essentially betting that Congress will only let this circus run for so long before they pull the curtain down.

So, what’s the final word from the crystal ball? Inconvenience is totally in the mix, but full-blown chaos? Not so much.

FAQ 🏛️🇺🇸

- Why did the 2026 government shutdown begin?

Because Congress couldn’t manage to pass funding for several agencies, including Homeland Security, before the Jan. 31 deadline. It’s like trying to bake a cake without any flour! - Which agencies are affected by the shutdown?

Oh, you know, just some minor players like DHS, Transportation, HUD, State, and Defense facing furloughs or service disruptions. No biggie. - What do prediction markets say about how long it will last?

Both Polymarket and Kalshi are betting low on a prolonged shutdown. I mean, we all have limits, right? - How much money is being wagered on shutdown outcomes?

Each market has raked in over $18 million in trading volume. Clearly, people love a good gamble.

Read More

- BTC PREDICTION. BTC cryptocurrency

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

2026-02-03 23:08