Ah, the strange dance of cryptocurrency – that wild beast awakened in November 2022, clawing its way back after the FTX fiasco, as if to say, “Look at me, I’m not dead yet!” Now, the trumpet sounds: the summit of this cycle looms near. But, lo and behold, amidst the turmoil, a sly opportunity sneaks in – a chance to clutch some shiny Bitcoin (BTC) or the flamboyant altcoins before the music stops.

Is the Post-halving Peak Like a Fickle Mistress? Expect 2029 If You’re Patient Enough

Legend has it that Q4 in the post-halving year is Bitcoin’s time to shine – an encore that dazzled us in December 2017 after the 2016 halving and again in November 2021, when BTC flirted with $69,000 like it was showing off at a cosmic ball. The last halving? April 2024, naturally, so prepare your wallets and your nerves for Q4 2025’s grand finale.

Now, buying at the “top” might sound like trying to catch a greased pig, but hey, market volatility is like a rollercoaster designed by madmen – exhilarating and full of sick-bags. And as crypto matures (sniff, growing up so fast!), these cycles stretch out longer, like an awkward family dinner that never ends. If the peak actually sneaks into early 2026, maybe cozy up and buy Bitcoin or Ethereum from September through December 2025. Otherwise, 2026 buyers face a marathon hold until late 2029. No pressure.

Of course, these escapades suit only the brave – the long-term hodlers. Futures traders, meanwhile, can roll around in chaos anytime they please.

Institutions Crash Ethereum’s Party: Time to Let the Price Discover Itself (and Your Wallet Cry)

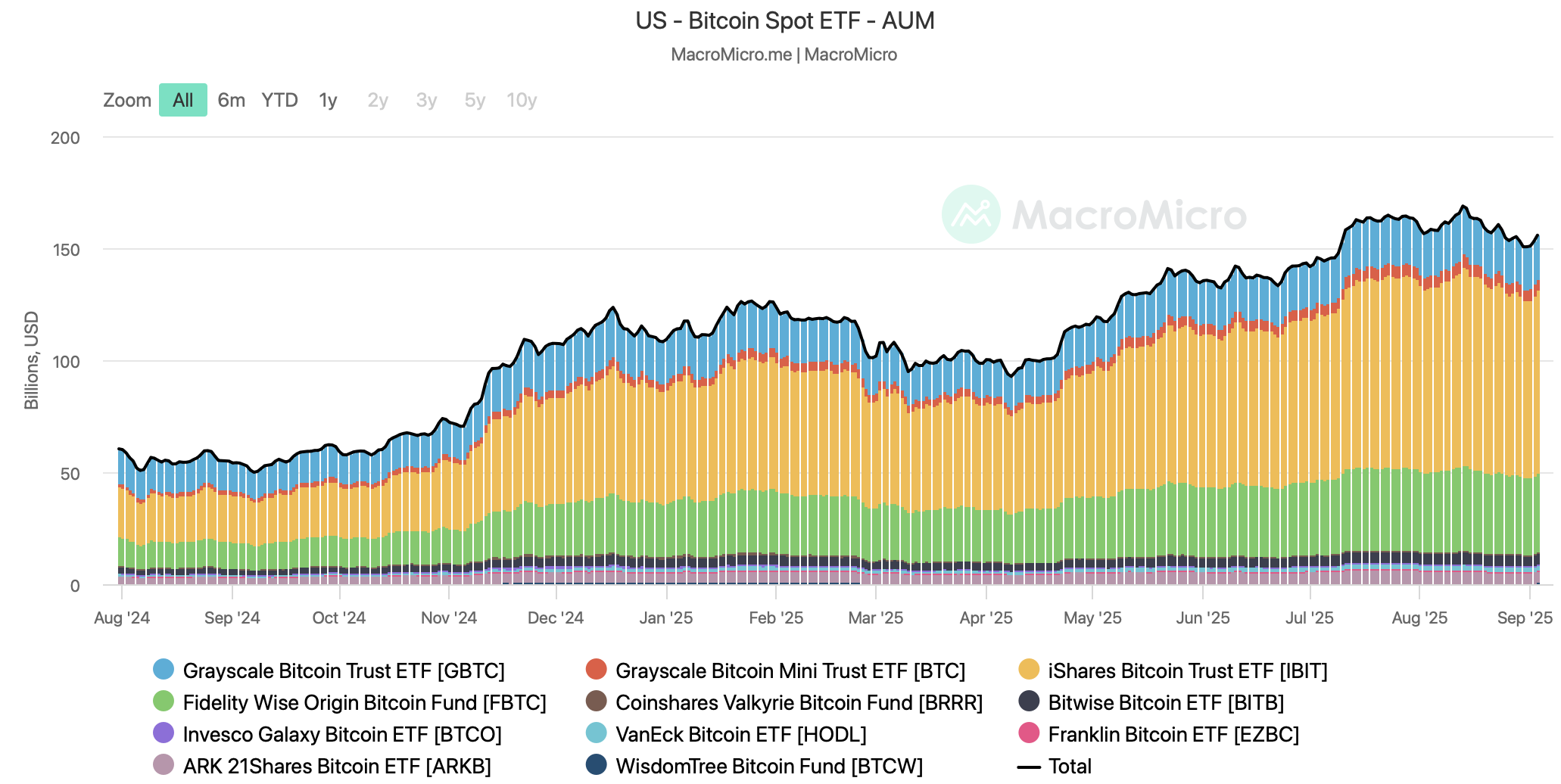

What makes this bullish frenzy different? Institutional money – those big suits who now actually want to dance with crypto volatility instead of sneaking through the back door. Gone are the days when they poked mining stocks or sought secret offshore whispers. Enter 2024, the year of Spot ETFs blooming like wildflowers: 11 Bitcoin ETFs in January, followed by Spot Ethereum ETFs in July. Now the whales can splash about securely, without fumbling for private keys like a mad magician.

Loved or loathed, the flood of capital into these ETFs seeks to hit a whopping $200 billion. A landmark for Web3, no doubt – but if you’re a regular trader, brace for prices that scream “Keep out!” louder than a bouncer at a VIP club.

If more institutional giants like Sharplink or ETHZilla keep taming the liquidity beast, Ethereum and Bitcoin might ascend so high, only astronauts and Elon Musk will reach them. So, a gentle nudge: buy now, before your “get rich” dreams turn into an expensive memory.

Bitcoin’s Security Budget Suffers a Digital Cold Sweat – Could This Be Its Swan Song?

And yet, lurking in the shadowy wings, quantum computers whisper doom. Bitcoin’s ironclad myth – the 21 million coin limit – might unravel like a poorly knit sweater, its scarcity story melting before investors’ eyes. Experts warn that if quantum tricks meddle with mining, Bitcoin won’t be special anymore. Investors might start ghosting faster than you can say “blockchain.”

Then there’s the security budget – the miners’ payday – which is under threat. Word on the street (or at least on U.Today’s pages) is that Bitcoin might not hold the fort post-2030.

So, with all this wisdom wrapped in digital enigma, here are three blessed reasons to powder your nose and dive into crypto by 2025. Because waiting? Well, that’s a gamble too – except this roulette spins with lasers and emojis. 🎲💥

Read More

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- Litecoin’s Wild Ride: $131 or Bust? 🚀💰

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

2025-09-05 20:19