In the whimsical world of Fundstrat’s prophecies, Tom Lee, the illustrious Head of Research, paints a rosy picture of a bullish 2026 for Bitcoin, tied to the waltz of quantitative tightening ending with the grace of a dovish Federal Reserve. Meanwhile, his fellow seers within the fund paint a starkly bleaker tableau, forecasting a heart-wrenching market drop in the first half of the same year. A veritable clash of titans! 🌩️🤯

Fundstrat: A Theatrical Divide in the Cryptic Crypto Drama

The Facts

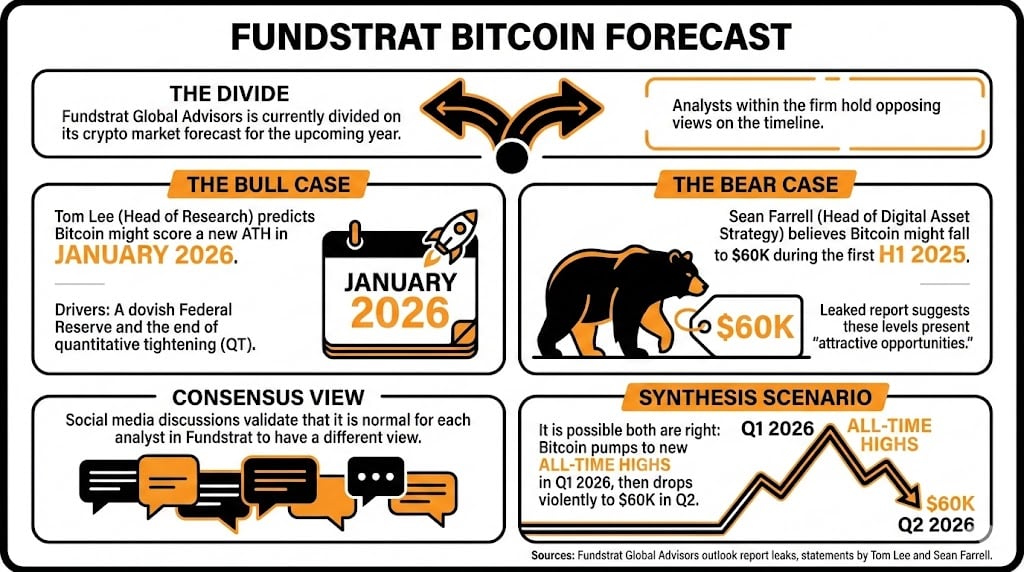

A certain Fundstrat Global Advisors, a firm whispered in the halls of financial media for its perennially bullish soothsaying, has found itself at a crossroads. The firm divides its crystal balls on its crypto market forecast for the year 2026.

Tom Lee, the managing partner and distinguished head of research with Fundstrat Global Advisors, joyfully predicts Bitcoin might just grace us with a new ATH come January 2026, led by a charmingly dovish new Federal Reserve and an end to the tiresome quantitative tightening cycle. Yet others within the firm-Oh, the irony-are less inclined to share in such a jubilant vision, bracing for a decidedly unromantic downturn.

In an accomplice to disclosure as a leaked Fundstrat outlook report-a mere shadow play on social media-Sean Farrell, not one to mince words, wagers that Bitcoin may yet bow gracefully to $60K during the first half of 2025. Such levels, he declares, are “attractive opportunities”-a euphemism for prospects most dire, no doubt. 📉

The chattering class on social media may have little interest in debate, as it perceives little novelty in the divergent viewpoints of Fundstrat’s ensemble of analysts.

Yet, in this splendid theatre of the absurd, there exists a twirling, dramatic possibility where both predictions are correct: Bitcoin achieving ethereal new all-time highs during Q1 2026, only to plummet rather unceremoniously to $60K in Q2. A real tragicomedy! 📈📉

Why It Is Indeed Quite Relevant

The contradictions within the same ensemble point to the unprecedented masquerade ball we find ourselves attending in the crypto world, where geopolitical shuffling contributes to a cacophony of opinions regarding the future of the cryptocurrency market.

Farrell has stated that his analysis is crafted for those with “crypto-heavy portfolios,” an “active approach” to market shenanigans, in stark contrast to Lee’s musings aimed at the mighty investors who harbor a more conservative tolerance for cryptocurrency volatility in their coffers.

Looking Toward the Next Act

Despite the apparent bedlam, Farell holds firm in his belief that Bitcoin shall ascend again to all-time highs in 2026, declaring that the venerated cryptocurrency will bring prosperity by abolishing “the traditional four-year cycle with a shorter, shallower bear.” A radical rethinking of economic certitudes, indeed. 🌟

FAQ: Decodings from Today’s Cryptocurrency Conundrum

-

What are the differing tea leaves read by Fundstrat regarding Bitcoin’s descent or ascent?

Tom Lee prophecies that Bitcoin might reach dazzling new heights in January 2026, while Sean Farrell sees a precipitous tumble to $60K in the first half of 2025. -

What causes the divergent dreams within Fundstrat?

Geopolitical winds and the tumultuous seas of the market contribute to varying interpretations of Bitcoin’s journey, illustrating the dizzying complexity of the present cryptocurrency stage. -

How does Sean Farrell’s strategy differ from Tom Lee’s?

Farrell champions an active investment strategy focused on crypto-rich portfolios, while Lee’s strategy targets the stately, less progressive investors who dedicate a modest portion of their wealth to Bitcoin and ether. -

Is it conceivable for both forecasts to take the stage?

Absolutely! Both could enact their roles if Bitcoin ascends to the pinnacle of glory in Q1 2026 only to humbly descend to $60K in Q2, showcasing the thrilling volatility of the crypto market’s grand drama.

Read More

- USD JPY PREDICTION

- EUR PHP PREDICTION

- EUR USD PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- USD MYR PREDICTION

- EUR THB PREDICTION

- Silver Rate Forecast

- USD INR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

2025-12-22 03:59