Ah, Bitcoin, the magnificent beast, trading at a regal $116,393 on the 19th of September, 2025! A market cap of $2.31 trillion-such grandeur! The 24-hour trading volume? A mere $36.67 billion, because why not? The price has danced between $116,349 and $117,888, as if it couldn’t decide which direction to go. How delightful! 🤑

Bitcoin

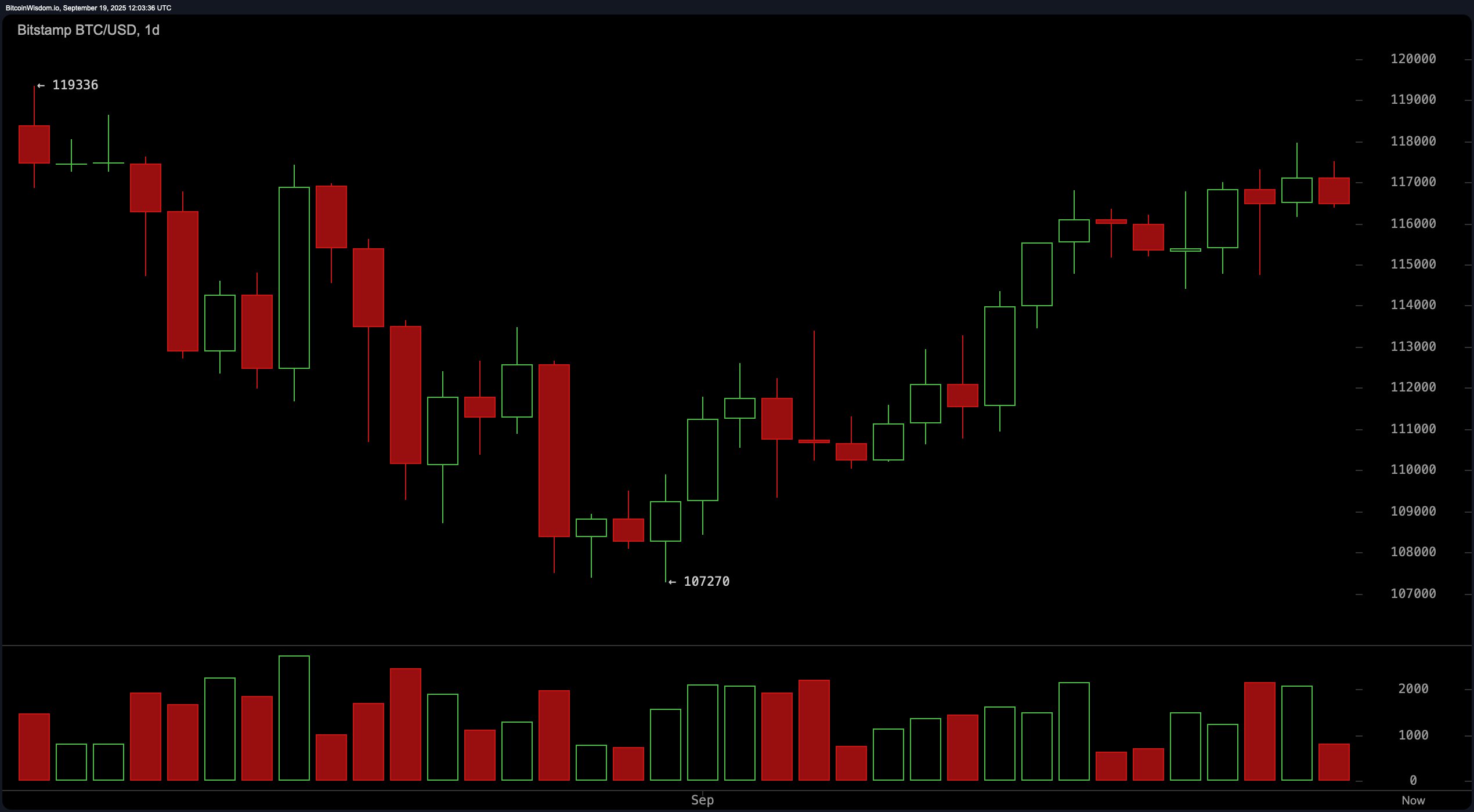

On the daily chart, Bitcoin has been on a charming uptrend since the beginning of September, bouncing like an energetic child from the $107,270 support level. And now, behold! It rests gently under the mighty resistance zone at $119,336, pondering whether it should leap higher or take a nap. 😴

The uptrend continues, but look at it-stuck in a tight range of $117,000-$118,000. One might say it’s unsure, perhaps afraid of the resistance above. The volume has grown modestly during the ascension, but recent candles suggest Bitcoin is getting cold feet. The buy zone? Between $113,500 and $114,500, of course, with the take-profit target resting between $118,000 and $119,500. The stop-loss? Under $111,000, naturally. Let’s not get too reckless! 😏

Now, on the 4-hour chart, Bitcoin hit a glorious peak at $117,968 before deciding it had had enough of the party. Bearish candles have begun to appear-oh dear! But fear not, the broader structure still supports our dear Bitcoin. Watch closely as it may dip to $115,000-$115,500 before picking itself back up. Who wouldn’t enjoy a little breather before the next rally? ⏳

The 1-hour chart shows a short-term downtrend. Bitcoin has been sliding gently down, just as a careless aristocrat might slip on a marble floor. Reaching $116,369, it’s now brushing against minor support. This correction is expected, so don’t panic just yet! A strong bullish candle near $116,000 could mean the return of the glorious uptrend, but until then, cautious optimism reigns. Be sure to set tight entries-no room for slothful moves! 🐢

As for the key technical indicators, we have a delightful circus! The RSI is at 58, perfectly neutral, as if it can’t decide whether to be pleased or disappointed. The Stochastic is prancing in overbought territory at 87-oh, a potential sell-off? How scandalous! The Commodity Channel Index (CCI) and ADX, however, seem more like bystanders, unsure of which drama to follow. As for the awesome oscillator? Well, it’s not sure what to make of it either. 🍿

Moving averages, however, are singing a more definite tune. All the short- and long-term averages below the price signal bullish momentum. The EMA and SMA for 10, 20, 30, 50, 100, and 200 periods align in sweet harmony, whispering “Yes, Bitcoin is still strong!” Let’s not forget about the EMA (200) at $105,738 and the SMA (200) at $103,240, which reinforce the positive outlook. 📈

To wrap this up-Bitcoin is indeed in a strong technical position on the daily chart. But there’s a catch! Traders must proceed with caution. If Bitcoin doesn’t break $118,000 with volume, there might be a temporary setback. Hold your breath, folks, the drama is just beginning. 💥

Bull Verdict:

Bitcoin remains in a structurally bullish position, with unwavering support from the moving averages and a well-established uptrend. If the price stays above $115,000-$116,000 and breaks through $118,000, a march toward $120,000 is surely in the cards. 🎩

Bear Verdict:

Despite all its glory, Bitcoin faces resistance and weakening momentum on the lower timeframes. Should it fail to reclaim $117,500 and sink below $115,000, a deeper retracement toward $113,000 might occur. Will this be the end of the rally? Only time will tell. 🐻

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

2025-09-19 16:28