Oh, the Ethereum price, that capricious darling of the digital world, is once again the center of all attention. A wave of bullish signals has emerged, raising the odds for a rally soon. This newfound optimism is due to the advanced institutional interest and on-chain metrics that reflect the accumulation by the whales, those majestic creatures of the crypto sea.

The current bullish sentiment has boosted market-wide sentiment, and analysts, with their noses buried in charts and data, are eyeing a breakout towards $3,500 in the short term. How delightful!

BlackRock Buys, Whale Wallets Expand

According to the ever-reliable CryptoGoos, BlackRock, the world’s largest asset manager, has reportedly bought $100 million worth of Ethereum in the past 7 days. This, my dear readers, is not just a purchase; it’s a statement. A statement of renewed institutional conviction in ETH’s future, a future that seems to be as bright as a midsummer’s day.

BREAKING:

BLACKROCK BOUGHT $100,000,000 WORTH OF $ETH THIS WEEK.

WHALES ARE LOADING UP!

— CryptoGoos (@crypto_goos) July 5, 2025

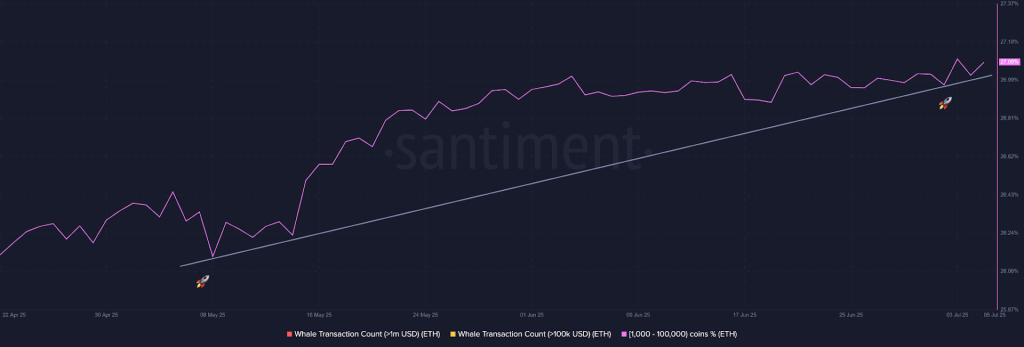

And if that weren’t enough, on-chain data displayed by Santiment also reveals a steady advancement in the holdings by wallet addresses with 1,000 to 100,000 ETH. It seems the mid- to large-sized whales have been accumulating since mid-May, a sign that confidence is not just rising, but soaring like a phoenix from the ashes.

As of early July, these addresses continue to rise, suggesting a consistent rise in confidence. Confidence, after all, is the lifeblood of any market, and the crypto market is no exception.

Record Shorts Could Trigger a Squeeze

Interestingly, while accumulation surges, speculators on CME have built one of the largest short ETH futures positions in history, according to Barchart. This extreme bearish positioning has caught the attention of analysts who are now raising the odds of a possible short squeeze scenario. Oh, the drama!

RECORD amount of $ETH shorts while Ethereum adoption is spiking

Ready for the massive short squeeze

— Quinten | 048.eth (@QuintenFrancois) July 5, 2025

Quinten Francois adds further fuel to this view, pointing to a surge in Ethereum adoption and inflows via bridged assets and stablecoin usage on Artemis. This growing demand, combined with overloaded short positioning, creates the perfect setup for a forced short-covering rally. A true spectacle, wouldn’t you say?

Box Breakout in Play: $3,500 on the Horizon?

Technically, Ethereum has been stuck in a sideways “box range” for weeks, but momentum is shifting. According to Mister Crypto, ETH recently performed a liquidity sweep below the box range, often a precursor to a breakout in the opposite direction. How poetic!

He believes a breakout from the upper box border near $2,500 could launch ETH toward $3,500 in the short term. A bold prediction, indeed!

The bottom is in.$ETH is about to explode!

— Mister Crypto (@misterrcrypto) July 5, 2025

This sentiment is echoed by Ted Pillows, who notes Ethereum is “flipping $2,500 resistance into support.” Marcus Corvinus takes it further, setting sights beyond $3,500, should the $2,500 mark hold. Combined with BlackRock’s recent buy and whale wallet growth, these chart signals are gaining credibility. A veritable storm is brewing, and we are all invited to watch the tempest.

FAQs

How much Ethereum does BlackRock currently hold, and how does this recent $100 million purchase fit into their strategy?

BlackRock is a significant holder of Ethereum. As of early July 2025, reports indicate BlackRock’s iShares Ethereum Trust (ETHA) holds around 1.57 million ETH, valued at over $3.85 billion, representing a substantial portion of the total ETH ETF market. The recent $100 million purchase (or specifically, $85.4 million on July 3) is part of their aggressive accumulation strategy, reflecting growing institutional confidence and a strategic pivot towards Ethereum. A move that is as bold as it is brilliant.

Is BlackRock’s involvement a definitive sign of institutional adoption, or could it be a short-term move?

BlackRock’s substantial and continuous accumulation of Ethereum, following their success with Bitcoin ETFs, is widely seen as a definitive sign of increasing institutional adoption. While some short-term tactical trades may occur, their overall strategy, characterized by low fees and consistent inflows into their ETF products, points to a long-term commitment to integrating digital assets into traditional finance, legitimizing crypto investments for a broader institutional audience. A move that is as strategic as it is visionary.

Read More

- BTC PREDICTION. BTC cryptocurrency

- ETH PREDICTION. ETH cryptocurrency

- CNY JPY PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- EUR USD PREDICTION

- XMR PREDICTION. XMR cryptocurrency

- EUR RUB PREDICTION

- USD VND PREDICTION

- USD INR PREDICTION

- GBP EUR PREDICTION

2025-07-05 15:23