Oh, dear Bitcoin! After reaching the dizzying heights of $123,000, you’ve decided to take a little breather and test the patience of your ardent admirers. Fear not, for you have found yourself in a rather delightful support zone, a confluence of technical indicators that would make even the most discerning art critic swoon.

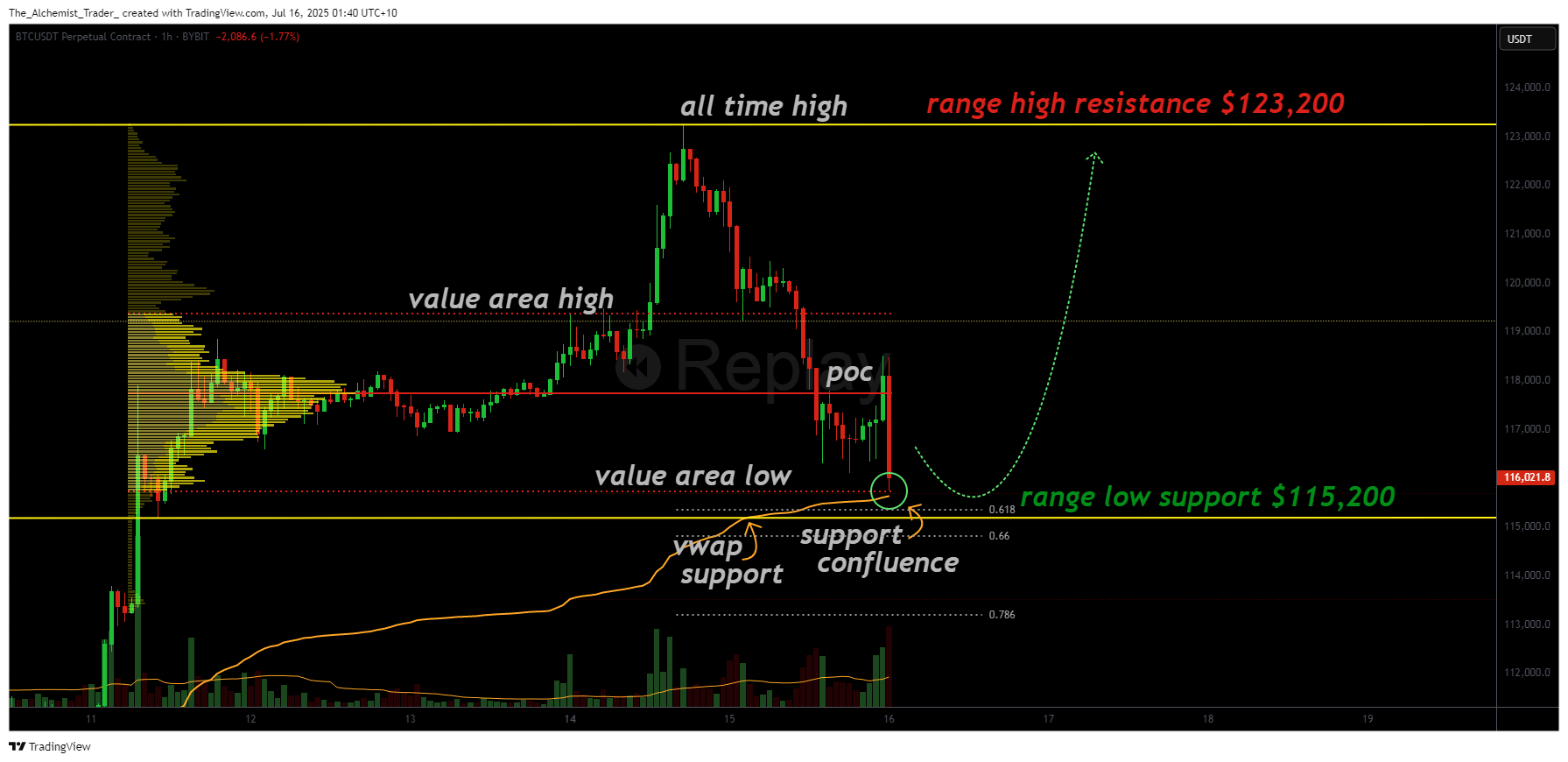

After that scandalous affair with the all-time high, Bitcoin has entered a corrective phase, a rather common occurrence after such a passionate tryst. But worry not, my dear cryptocurrency, for this pullback appears to be quite healthy and has brought you into a critical support zone, a region where the value area low, VWAP, and 0.618 Fibonacci retracement have all converged to form a potential launchpad for a renewed move towards the highs.

Key technical points

- Support Zone Confluence: Bitcoin is testing a region combining the value area low, VWAP, and 0.618 Fibonacci retracement.

- Market Auction Complete: Loss of value area high followed by a test of value area low confirms full market rotation.

- Range Support at $115,200: This is the key high time frame support to maintain bullish structure and keep the range intact.

Bitcoin’s recent correction has brought price action back down into a critical technical support area after posting an all-time high around $123,000. This pullback aligns with standard market behavior following such a strong rally, but more importantly, the correction has reached a zone with strong technical overlap.

The support region around $115,200 includes the value area low, anchored VWAP support, and the 0.618 Fibonacci retracement from the previous impulse, all converging to form a potential bounce zone. This convergence increases the probability that the current dip could be a retracement rather than the beginning of a deeper reversal.

Additionally, the current correction has completed what’s known as a full market auction rotation. After losing the value area high, price has cycled through the range and tested the value area low, a typical pattern in sideways or range-bound markets. This structural behavior suggests Bitcoin is still trading within a high time frame consolidation, rather than entering a full-blown downtrend.

As long as price holds above the range low near $115,200, the high time frame range remains intact. This opens the door for a possible rotation back toward the $123,000 level. Should bulls reclaim that level, a break into price discovery and a new all-time high becomes highly probable.

What to expect in the coming price action

Bitcoin must continue to hold above $115,200 to maintain the current range structure. If this support holds, a rotation back toward the $123,000 level is likely. A breakout above that resistance could trigger a fresh all-time high. However, if the current support zone fails, it would break the range and potentially lead to deeper downside exploration.

Read More

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- EUR USD PREDICTION

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

2025-07-15 23:24