While the weight of selling pressure has not entirely lifted, the faint stirrings of hope are seen in the rebounding open interest and a subtle but noticeable rise in intraday demand. Could this be a sign of an impending short-term stabilization? Only time will tell. 🧐

Open Interest Rebounds as WLD Attempts Intraday Recovery

According to the hourly data from Coinalyze, Worldcoin seems to be wading through a rather mixed trading environment-one that oscillates between early-week weakness and a rather unimpressive, yet mildly encouraging, recovery. At first, WLD slumped, losing steam through a series of tight red candles, drifting dangerously toward the $0.62 abyss. But then, like a faint glimmer of hope, buyers stepped in, causing a soft bounce towards $0.703. Yet, despite this renewed activity, the underlying trend remains as fragile as an old porcelain teacup. 🍵

In the world of derivatives, open interest has seen a slight uptick to about 86.88 million, recovering from its recent lows of 86.46 million. This could be a sign that traders, once huddled in defensive positions, are cautiously dipping their toes back into the market. However, let’s not get too excited-this rebound is modest at best, suggesting that traders are still not quite convinced enough to go all-in with aggressive bets. 🏀

The synchronized movement of price and open interest suggests that the sellers may finally be running out of steam. For now, the market shows a slowing of downward momentum, followed by a hesitant push upward. But let’s be real, this “recovery” is barely more than a tentative shuffle. To truly turn the tide, Worldcoin will need to string together higher lows and see a steady flow of open interest. Fingers crossed! 🤞

Data Shows Price Drifting Lower, but Market Cap Remains Stable

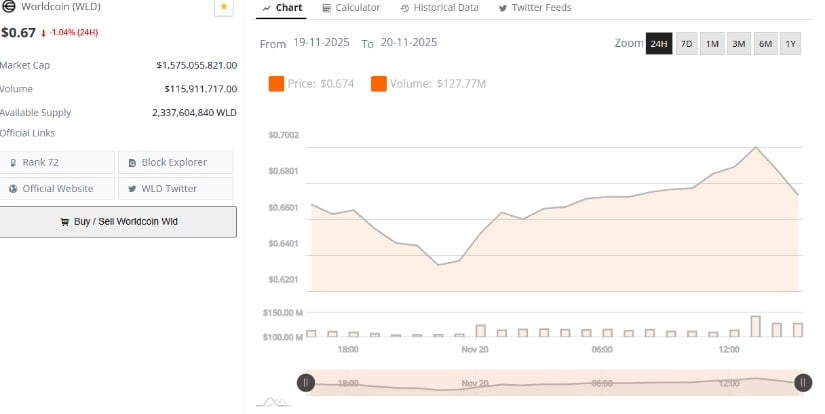

BraveNewCoin reports that Worldcoin is hanging around the $0.67 mark, down a modest 1.04% in the past 24 hours. Despite this minor dip, the market capitalization still stands at a respectable $1.57 billion, bolstered by a circulating supply of 2.33 billion tokens. Trading volume clocks in at $115.9 million, a reassuring figure that speaks to continued interest, even amid the choppy waters of market corrections. 📉

For the short-term, Worldcoin’s price range has fluctuated between $0.62 and $0.70, showing some contraction after earlier volatility. The coin now seems to be hovering near the lower-middle portion of its range, as the broader sentiment in the crypto market shifts. But here’s a hopeful note: the fact that it remains above $0.62 is a positive sign, indicating that buyers are at least putting up a fight. 💪

TradingView Technicals Show Flattening Momentum With Potential for Gradual Turnaround

On the daily chart from TradingView, WLD is currently trading at $0.702, showing an intraday gain of 5.25% as buyers attempt to claw back some of the lost ground. The price is still below the Bollinger Band basis of $0.747, signaling that Worldcoin is caught in the midst of a broader downtrend. However, the recent lift from the lower band at $0.617 offers a glimmer of hope that the downward pressure might be easing. Slowly, but surely. 🐢

On the technical front, the MACD remains in the negative territory, with the MACD line sitting at -0.062 and the signal line slightly below at -0.064. However, there’s a hint of positivity as the histogram has turned a little brighter at 0.002. This is typically an early sign of a momentum recovery, but let’s not get ahead of ourselves-real confirmation will require a sustained move above the mid-band and an uptick in buying volume. Hold your horses! 🐎

The market structure shows a slow decline in volatility after the sharp downside moves earlier in the month. If Worldcoin can consistently close above $0.70 and push towards resistance at the Bollinger Band, confidence may begin to grow. But let’s not forget, if it fails to defend the crucial $0.62-$0.64 support zone, all bets are off. 🚨

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- EUR USD PREDICTION

- POL PREDICTION. POL cryptocurrency

- CNY JPY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- GBP CNY PREDICTION

- EUR KRW PREDICTION

- GBP RUB PREDICTION

2025-11-21 00:38