In the grand theater of finance, where fortunes rise and fall like the tides, XLM clings to its $0.32 perch with the tenacity of a drunkard clinging to a lamppost. Buyers and sellers spar like bumbling actors in a farcical play, neither side quite grasping the script. Consolidation looms-a stage direction no one truly understands but all must obey.

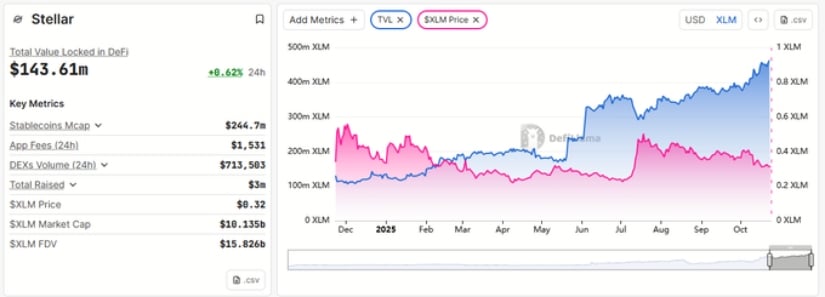

TVL Growth Signals Fundamental Strength

Stellar’s Total Value Locked (TVL) has surged to 456 million tokens ($143.61 million), a feat achieved even as the token languishes at half its December 2024 glory. One might call this a triumph of hope over arithmetic-or perhaps a case of the network’s DeFi protocols throwing a lavish party while the guest of honor sips lukewarm tea. The integration of stablecoins, liquidity pools, and staking rewards has become a three-act opera of financial alchemy, with Soroban’s smart contracts conducting the orchestra with the grace of a caffeinated conductor.

Meanwhile, stablecoin activity hums along like a well-oiled clockwork, its $244 million market cap a testament to Stellar’s role as the Swiss Army knife of cross-border transactions. Who needs romance when you’ve got remittances?

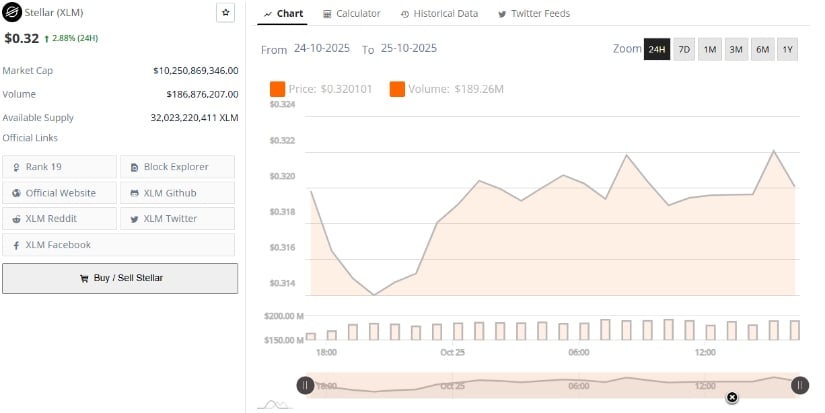

Market Holds Steady at $0.32 Amid Market Volatility

At $0.32, XLM basks in the dubious honor of being 2.88% richer in 24 hours-a minor victory in a war where the enemy is often oneself. With a $10.25 billion market cap and $186.8 million in daily trading volume, it’s the crypto equivalent of a middle-aged man in a tailored suit, pretending he’s still in his prime. On-chain data reveals a curious trend: tokens are fleeing exchanges like overpriced taxis, opting instead for the long-term embrace of staking. One wonders if this is wisdom or merely a midlife crisis.

Investor confidence, it seems, is a fickle muse. Yet here it is, thriving amidst the chaos, like a daisy growing through a crack in the sidewalk of economic despair.

Technical Indicators Suggest Consolidation Phase

The July 2025 rally from $0.20 to $0.52 reads like a Shakespearean tragedy-full of promise, undone by hubris. October’s plunge to $0.16 was the villain’s monologue, followed by a reluctant rebound to $0.32. The Bollinger Bands Power histogram, with its red bars of October gloom and neutral hues of October’s twilight, resembles a stock market horoscope penned by a caffeine-deprived astrologer. The Chaikin Money Flow, at 0.09, whispers of inflows outpacing outflows, a subtle dance of capital that might just be the prelude to a comeback-or a slow waltz into oblivion.

Together, these indicators form a tapestry of uncertainty, stitched with threads of optimism and doubt. Whether this is a base-building phase or a prelude to another collapse remains to be seen. After all, in the world of crypto, even the most bullish forecasts come with a side of existential dread. 🤷♂️📈

Read More

- EUR USD PREDICTION

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

- USD MYR PREDICTION

- WLD PREDICTION. WLD cryptocurrency

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

2025-10-25 23:24