Key Insights:

- XLM must close above $1 to validate a long-term bullish breakout, according to Peter Brandt.

- Stellar is gaining momentum from July’s Protocol 23 upgrade and PayPal’s PYUSD integration.

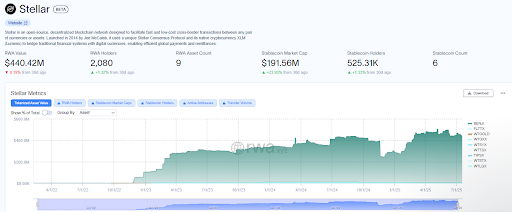

- Institutional tokenization on Stellar now stands at more than $445 million, in a show of strong fundamentals.

Hey there, crypto enthusiasts! Veteran trader Peter Brandt has his eyes on XLM, and he’s not pulling any punches. If you thought $7 was a stretch, think again! But here’s the catch: XLM needs to do a little dance and close above $1 before we get all excited. Otherwise, it’s just going to twirl around in a range, like a bored ballerina. 😅

XLM’s Bullish Setup

Brandt, the market prediction wizard, calls XLM the most bullish chart of all. He’s got two long-term technical formations on his side: a multi-year ascending triangle and a cup-and-handle pattern. Historically, these formations are like a magic spell, but they only work if XLM stays above its April low of $0.20 and decisively closes above $1. Until then, it’s just a range-bound twirl. 🎩

Potentially the most bullish chart of all belongs to XLM MUST MUST remain above Apr low and MUST MUST close decisively above $1. Until then this chart will remain range bound

— Peter Brandt (@PeterLBrandt)

Until this happens, the price is likely to remain stuck in a range. But hey, at least it’s not a boring one! 🤷♂️

His analysis isn’t just technical. It shows a more general market sentiment that sees Stellar as in a great position to ride the next wave of crypto adoption. If it can overcome resistance and confirm the breakout, that is.

“XLM MUST MUST remain above Apr low and MUST MUST close decisively above $1. Until then, this chart will remain range-bound,” Brandt posted on social media.

XLM’s Historical Price Struggles

Stellar’s price history offers context for this outlook. Since hitting its all-time high in early 2018, XLM has been stuck in a symmetrical triangle formation. Despite attempts to break out in 2021 and late 2024, the price has repeatedly retreated. As of July 19, XLM is trading around $0.50, which is its highest level in over a year. This also stands as a 120% gain since the start of July. Yet it’s still far from the $1 level that Brandt describes as the gatekeeper to further gains.

This barrier isn’t just psychological; it’s structural. A break above it would validate the multi-year bullish formations and could even trigger a rally to Brandt’s long-term target of $7.20. For some more perspective, this would bring in a 14x return from current levels. 🤯

Why July Changed the Game for XLM

July has been a turning point for Stellar, with the cryptocurrency enjoying attention from three major developments. The first of these is Stellar’s upcoming Protocol 23, which introduces improvements that improve smart contract performance and lower costs across the network. The second of these is how PayPal’s USD-backed stablecoin, PYUSD, is set to integrate with Stellar. This move could massively expand XLM’s utility by enabling near-instant, low-cost cross-border transfers around the world. Finally, data from RWA.xyz shows that over $445 million in real-world assets (RWAs) have been tokenized on Stellar. Large asset managers like Franklin Templeton and Circle are leading this trend, and the future appears bright for this cryptocurrency.

Considering the similarity between XRP and XLM in terms of cross-border payments, XLM could be on the verge of following XRP’s footsteps after the latter recently hit a high of $3.65. 🚀

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- NEXO PREDICTION. NEXO cryptocurrency

- CNY JPY PREDICTION

- STX PREDICTION. STX cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- BTC PREDICTION. BTC cryptocurrency

- Is XRP About to Soar or Crash? The $3.27 Dilemma Explained!

- 🐳 Crypto Whales Beware: Phishing Plunge Masks Sinister Shift! 🕵️♂️

2025-07-19 20:47