Markets

What to know:

- Well, hold onto your hats, folks! The U.S.-listed spot XRP ETFs have been on a tear, racking up 30 days of net inflows since their grand debut on Nov. 13. Meanwhile, Bitcoin and Ether ETFs? They’ve been having a bit of a dry spell, bless their hearts. 🙈

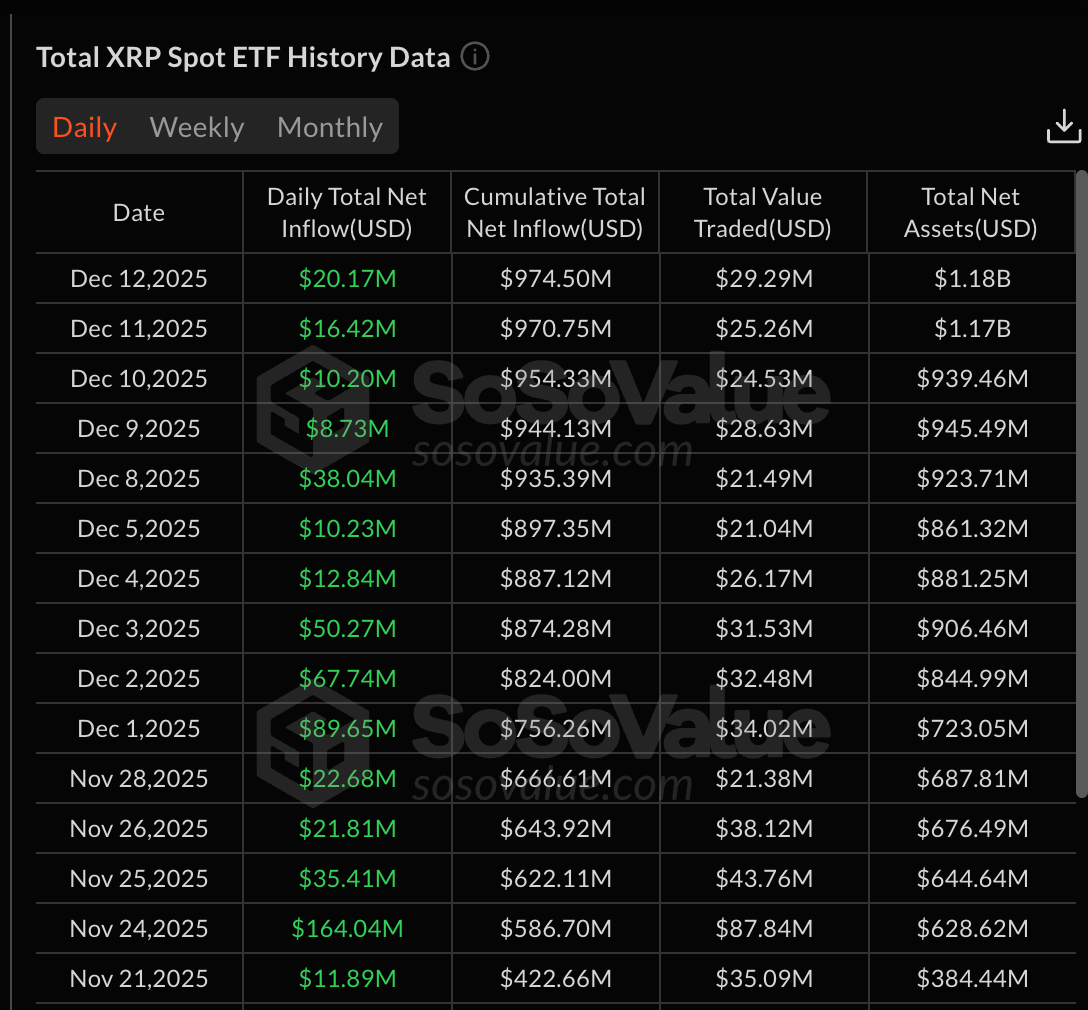

- As of Dec. 12, these sprightly XRP ETFs have managed to hoard around $975 million in net inflows, with total net assets sauntering up to about $1.18 billion. Quite the impressive haul, wouldn’t you say? 💸

- The steady stream of dosh flowing into XRP ETFs suggests they’re not just a flash in the pan; investors seem to be using them for structural allocations, much like a well-furnished drawing room-everyone wants a piece! 🛋️

Our dear U.S.-listed spot exchange-traded funds (ETFs) have been prancing about with 30 consecutive trading days of net inflows since their launch on Nov. 13. This is all rather splendid, especially compared to their bitcoin and ether counterparts, which have been experiencing a series of unfortunate outflow events. Talk about a rough patch! 😬

According to our friends at SoSoValue, XRP spot ETFs have been like a persistent rain shower of fresh capital every trading day since they arrived on the scene, boosting cumulative net inflows to about $975 million as of Dec. 12. Total net assets across these sprightly products have climbed to roughly $1.18 billion, and lo and behold, there hasn’t been a single session of net redemptions. Remarkable, isn’t it? 🌧️➡️🌈

This uninterrupted streak is rather like comparing a charming village fête to the chaos of a city carnival, isn’t it? While U.S. spot bitcoin and ether funds-the big cheese of the crypto world-have been experiencing their share of wobbles due to shifting interest-rate expectations and other market shenanigans, our gallant XRP-linked products have been pulling in steady (albeit modest) allocations through this turbulent time. Quite the contrast! 🏰 vs. 🎢

The consistent inflows may indicate that XRP ETFs are being treated more like a trusty steed for structural allocation rather than a sprightly pony for tactical trading. While bitcoin ETFs often play the role of a proxy for the broader liquidity conditions-a bit like a barometer for financial weather-XRP funds seem to be capturing the fancy of investors seeking a bit of variety in their crypto diet. 🍽️

This flow profile also reflects the changing tides in the crypto ETF market. Instead of putting all their eggs in the bitcoin and ether basket (which, let’s be honest, can lead to a rather lopsided omelette), savvy investors are spreading their wings and exploring alternative assets with clearer use cases, like payments and settlement infrastructure. A fine strategy, if I do say so myself! 🥚🐣

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- CNY JPY PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- BTC PREDICTION. BTC cryptocurrency

- GBP CNY PREDICTION

- EUR BRL PREDICTION

- EUR RUB PREDICTION

- USD INR PREDICTION

2025-12-15 08:13