Behold, a whisper of hope! Grayscale’s recent XRP spot ETF filing has stirred the market, as if a candle were lit in a darkened room. Institutional adoption, that fickle lover, now casts its gaze upon XRP, promising a possible rebound. Yet, the shadows of short-term risks loom, like a storm brewing behind the clouds. 🌩️

Death Cross Raises Short-Term Concerns

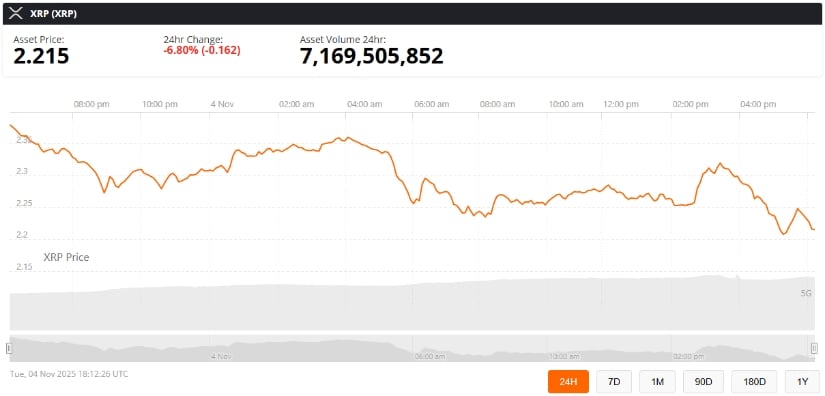

On the technical front, XRP has recently formed a death cross on its 10-day and 20-day Exponential Moving Averages (EMAs) at the $2.70 level. Technical analyst @ChartNerdTA muses, “Death crosses are lagging indicators, like a sigh after the storm has passed.” They often signal that the worst of the pain has been felt, but who can say? 🌑

The same analysis notes potential support zones in the $2.00 vicinity, with further downside possible if selling pressure persists. Despite this, the macrostructure of XRP remains intact, as if a tree, though shaken, still stands. Analysts highlight that past corrections following death crosses have sometimes paved the way for renewed upward momentum-like a phoenix, if you believe in such things. 🦅

Hidden Bullish Divergence Provides a Silver Lining

Despite bearish short-term indicators, a hidden bullish divergence has emerged on XRP’s monthly chart. Analyst @jaydee_757 points out that “XRP’s monthly lows are rising while RSI forms lower lows, signaling a potential continuation of the bullish trend if $2.09 support holds.” A flicker of light in the darkness, perhaps? 🌟

This divergence suggests that, even amid recent price drops, underlying momentum could support a recovery. JD emphasizes trading discipline, cautioning against hype surrounding events like Ripple’s Swell 2025 or the CLARITY Act (H.R.3633), stating that such distractions often cause retail investors to act as “exit liquidity” during price surges. A noble role, if you ask the market. 🧾

Grayscale XRP ETF Filing Boosts Market Sentiment

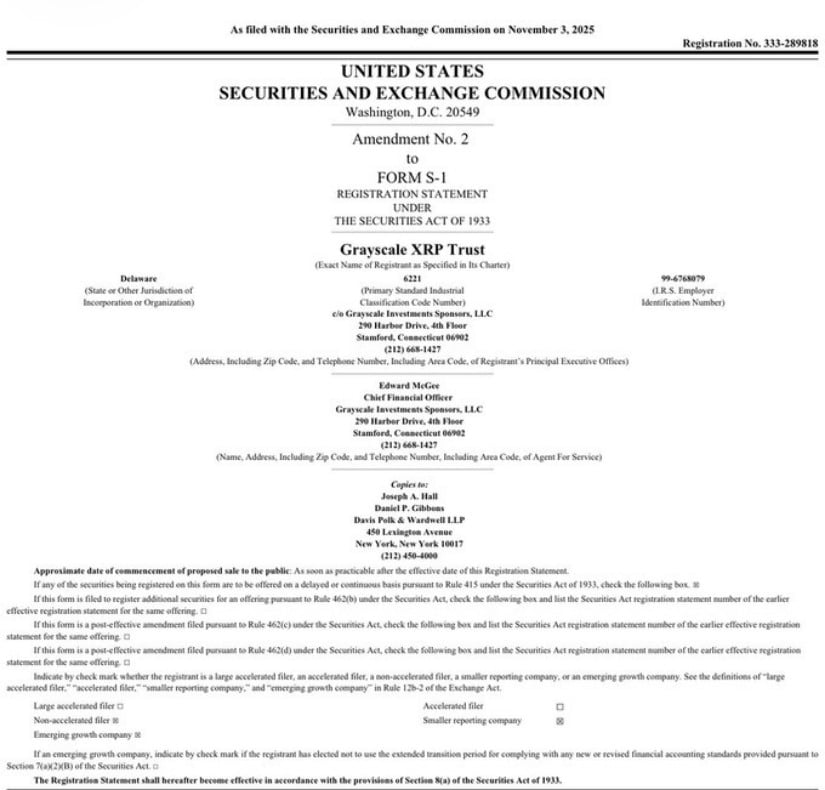

Adding a bullish catalyst to XRP’s outlook, Grayscale Investments recently submitted Amendment No. 2 to Form S-1 for the Grayscale XRP Trust. This filing moves the trust closer to launching a spot XRP ETF, which could open the cryptocurrency to regulated institutional investment in the U.S. A beacon of hope, or merely a mirage? 🌅

Crypto commentator @Steph_iscrypto reports, “BREAKING: Grayscale just submitted a fresh amendment for its $XRP ETF,” sparking optimism across the community. Several X users highlighted the potential impact on XRP’s price, noting that ETF approval could drive inflows and possibly push XRP toward new all-time highs. A dream, perhaps, but dreams are free. 🎯

Industry observers note that the filing follows a growing trend of institutional adoption for digital assets, with regulated ETFs providing safer avenues for large-scale investors. The SEC’s EDGAR database confirms the amendment, signaling a formal step toward mainstream access. A step, or a stumble? Only time will tell. 🕰️

Final Thoughts

XRP is navigating a challenging period, with the recent death cross at $2.70 signaling short-term pressure. However, technical insights like the hidden bullish divergence on the monthly chart, combined with institutional developments such as the Grayscale XRP spot ETF filing, suggest that upside potential remains. A dance between despair and hope, as ever. 🕺

Investors should stay cautious but remain attentive to these positive catalysts. Balancing short-term technical risks with long-term growth opportunities may provide the best strategy for navigating XRP’s evolving market landscape. A game of chess, where every move is a gamble. 🎲

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- STX PREDICTION. STX cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- CNY JPY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- USD MYR PREDICTION

- INJ PREDICTION. INJ cryptocurrency

- EUR ARS PREDICTION

- DOGE PREDICTION. DOGE cryptocurrency

2025-11-05 01:59