The crypto market is currently experiencing a level of excitement that would make a toddler with a broken toy proud. As of September 26, the global market cap is sitting at a cozy $3.74 trillion, down 2.27% in 24 hours. The Fear & Greed Index has slipped to 32 (Fear), showing clear risk-off sentiment. Altcoins are particularly hit, with the average RSI at 35.85 indicating oversold conditions. XRP is no exception, falling to $2.76, down 3.3% in a day and over 9% in a week. So why exactly is XRP under pressure today? Let’s break it down. 🤯

Factors Behind XRP Price Fall

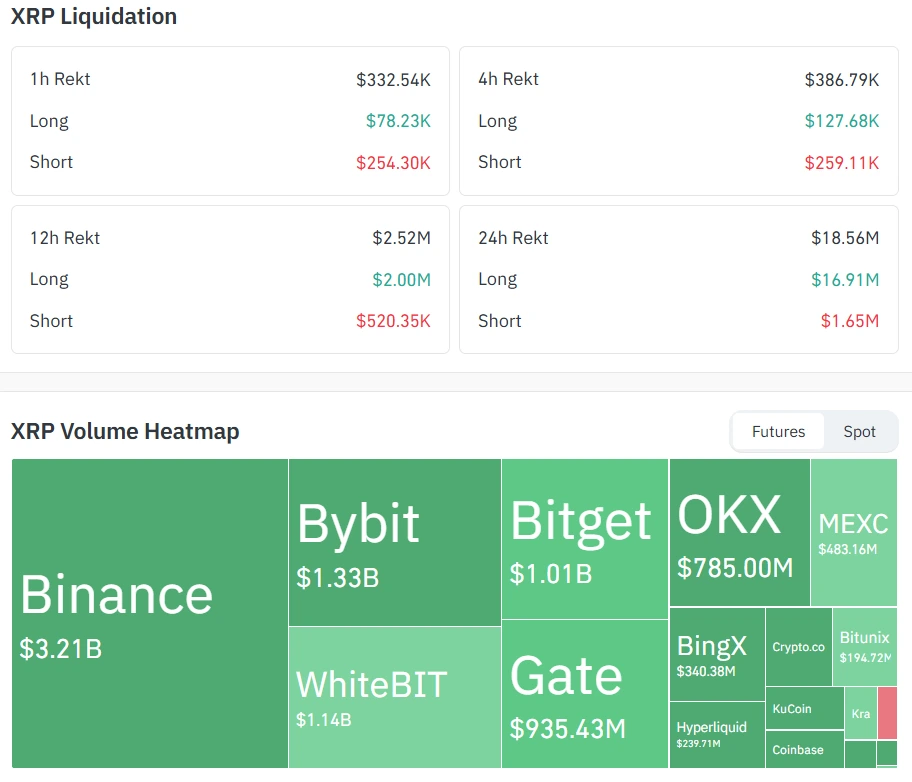

1. Macro Liquidation Cascade The broader crypto market just faced a $1.5 billion liquidation wave after Ethereum dropped below $4,000. With XRP closely tied to market sentiment, it suffered sharp outflows as leveraged positions unwound. XRP’s 24-hour volume spiked 30.7% to $8.73B, signaling panic-driven selling. Adding to the pain, open interest rose 7.92% to $1.11T, suggesting traders were caught on the wrong side of the move. 🚨

2. Technical Support Failure On charts, XRP broke down below the $2.81 Fibonacci retracement and its 100-hour moving average. This invalidated a bullish setup that had defended the $2.71 floor since July 2025. The RSI dipped to 29.24 (oversold) while the MACD flipped negative, showing clear bearish momentum. Analysts now warn that a decisive close below $2.71 could drag XRP toward the $2.50-$2.55 zone. 📉

3. ETF Approval Profit-Taking Ironically, positive news also played a role in the drop. The SEC approved a Hashdex ETF holding XRP/SOL/XLM on September 25, but instead of a rally, XRP saw heavy selling. Traders had already priced in the event after an 8% run-up earlier in the week and rushed to “sell the news.” While the ETF drew $37.75M in spot volume on its launch day, it was modest compared to BTC and ETH products, muting optimism. 😂

XRP Price Analysis

At the time of writing, XRP price is at $2.76, with a market cap of $165.21B. It has posted a daily low of $2.74 and a high of $2.87. Trading volumes remain elevated, which highlights both panic selling and speculative positioning. 🧠

The $2.71 level is now the key short-term support. A bounce here could stabilize XRP, especially if broader market sentiment recovers. However, a clean break below $2.71 opens the door to $2.55, a level last tested in June. On the upside, reclaiming $2.81 on a daily close would be an early sign of strength, while a move above $2.99 could neutralize bearish momentum. 🎯

FAQs

Why is XRP dropping despite ETF approval? Because traders used the approval as an opportunity to lock in profits after a pre-announcement rally. 🤯 What key level should XRP investors watch? $2.71 is the make-or-break level. Holding it signals accumulation, but losing it may lead to $2.55. 🚨 Is XRP oversold right now? Yes, RSI readings are near oversold territory, but bearish momentum remains strong until $2.81 is reclaimed. 📉

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

2025-09-26 10:23