KEY POINTS:

IBIT hits $100B faster than I can say ‘to the moon’ – seriously, it’s like crypto on steroids. 💸

Larry Fink’s out here screaming about ‘tokenizing everything,’ because why not turn your grandma’s house into a digital doodad? 😂

And hey, while we’re at it, best altcoins? $HYPER and $SNORT, because apparently I need more ways to lose money in style.

So there I was, sipping my coffee, minding my own business, when suddenly BlackRock’s iShares Bitcoin Trust decides to go all Gabriela Sabatini on the finance world and breaches the $100B AUM mark. Boom – institutional crypto adoption, they call it, but I call it a bunch of suits finally texting emojis instead of banning them. Am I right?

But no, they don’t kick back and order pizza. Nope, BlackRock’s charging ahead into this ‘asset tokenization’ nonsense, basically shoving blockchain into finance like trying to fit a orgy into a phone booth. Smashing, isn’t it? 🤷♂️

Launched on January 11, 2024 – yeah, I remember, it was bitterly cold and I was complaining about my socks – IBIT’s exploded like a bad breakup text. It’s now gunning for the top 20 ETFs, leaving Vanguard’s S&P 500 in the dust, which took seven years to hit $100B. Seven years! That’s like waiting for your ex to realize they were wrong. 🐢

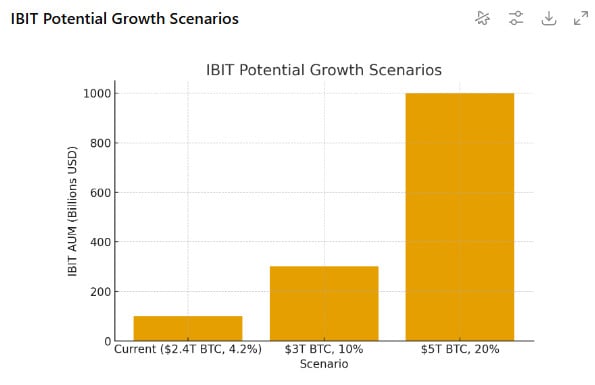

According to some analysis I pretend to understand, IBIT’s way out front with its $100B, while Fidelity’s FBTC lounges at $26.1B and Grayscale’s GBTC at $22.2B. Poor things, stuck in the slow lane like me at a family reunion. 🥇

$6.5B poured in last month? That’s the kind of money that makes me check my own pockets twice. Larry Fink, ever the drama queen, pronounces the ‘tokenization of all assets.’ Because obviously, we need to digitize everything short of my coffee mug. ☕

This could mean:

- Real estate: Fractional ownership? Sure, let’s all own a sliver of a haunted house together. Ghostly profits await! 👻

- Equities & bonds: Tokenized whatever, meaning your stock certificates now glow in the dark. 🌟

- Money market & short-term instruments: BlackRock’s dipping their toes in, like a toddler in the bath. 🛁

- Other securities and structured products: Wrapped up digitally, because who wants paper when you can have pixels? 📱

Oh, and the global $4.5T ETF market? Fink says it’s all fair game for tokenization, making international money as easy to access as bad reality TV. Channel surf at will! 📺

With IBIT teetering at $100B (hey, it teeters, I checked), it’s clear this is the start of some Frankenstein marriage between old-school finance and crypto. Step right up, folks! 🎢

Which brings us to the best crypto to buy now – you know, because I said so. $HYPER, $SNORT, and $SOL. Let’s dive in, shall we? 💻

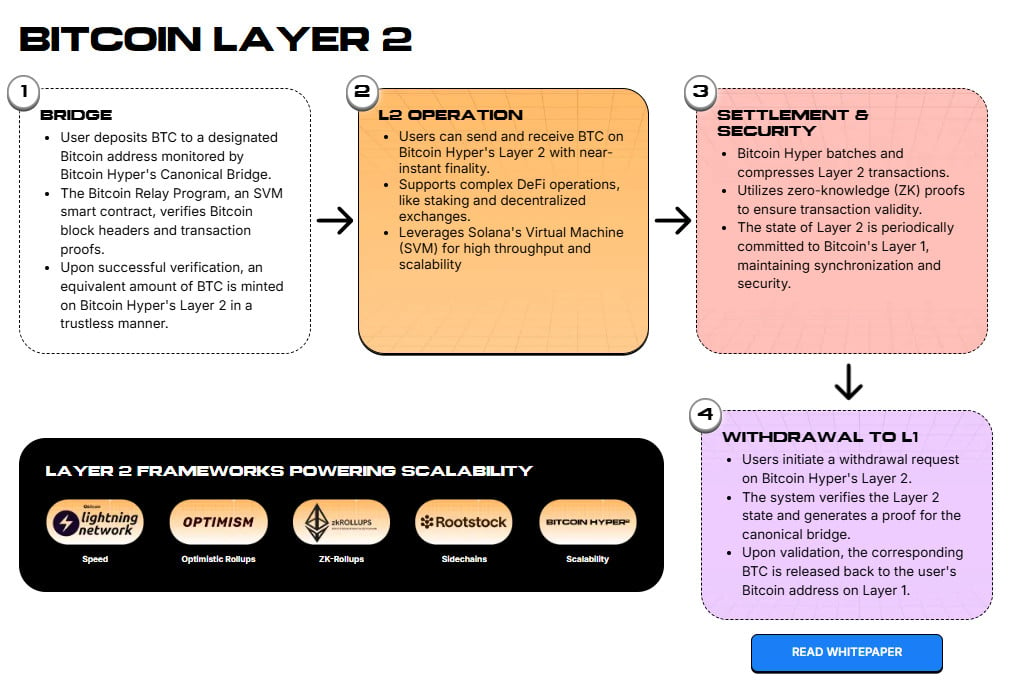

1. Bitcoin Hyper ($HYPER) – Turning $BTC into Quickie Payments, Because Why Not? 🤑

Bitcoin Hyper? Oh, it’s a love letter back to Satoshi’s wild dreams: real cryptocurrency for payments everywhere. Not like Bitcoin today, which is more store-of-value than Swiss Army knife – all hoarded and hard to use for that latte order.

Problems? Weak throughput, puny TPS (say, 6-7, like counting sheep on a deadline), and dumbed-down smart contracts. Congestion city, baby, with fees spiking like my blood pressure after bad news. 🙄

- Low throughput: Traffic jams for transactions.

- Low TPS: Everything moves slower than my grandma’s dial-up. 🐌

- Simple smart contracts: So basic, even Excel could outsmart it.

$HYPER and $BTC play nice on SVM – fully in the game. Presale’s hit $23.5M, with whales dropping $379.9K and $274K like it’s Monopoly money. Price could hit $0.15 by 2025? Yeah, right, color me skeptical. But hey, learn to buy $HYPER and dive in – regrets optional! 😉

Don’t miss the hype train pulling out of the station today.

2. Snorter Token ($SNORT) – Sniff Out Meme Coins Like a Pro, Because Manual Hunting is For Losers 🐽

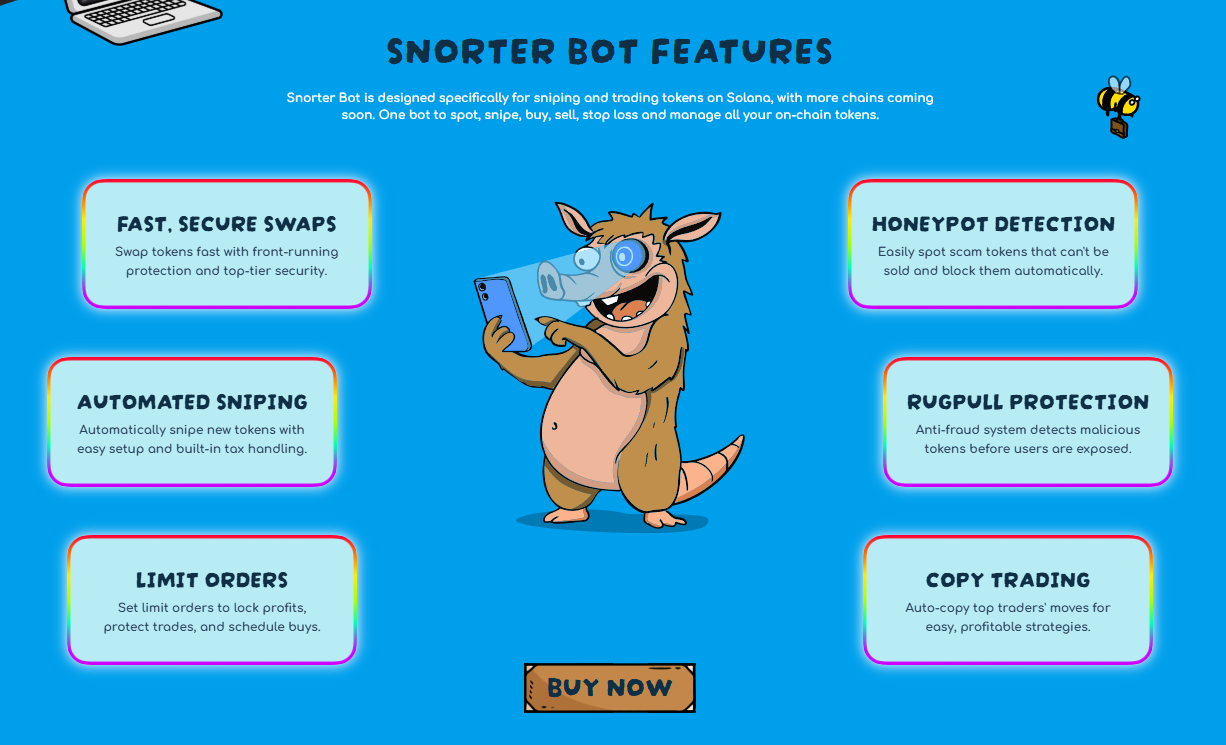

Forget sweating through meme coin mines like some digital gold prospector. Snorter Bot, powered by $SNORT, does the dirty work – hunts down juicy opportunities and hands you the tools to nab the next big flop.

Utility? Oh, it’s stuffed: Automated sniping (bye-bye slow reflexes), stop-loss/take-profit (for when it all goes south), and rugpull/honeypot shields (because not everyone’s honest). Snorter’s Solana-native, trolling Telegram for tiny cap gems.

- Automated sniping tools: Laziness elevated to an art. 🎯

- Stop loss/take profit order: Hope for the best, plan for the worst.

- Rugpull and honeypot protection built-in: Like a bodyguard for your wallet. 🛡️

Presale’s yanked in $4.7M, wrapping up soon – grab $SNORT at $0.1079 now, or pay through the nose later. Experts say $1.92 by year-end? Sure, and pigs fly without $SNORT. Learn to buy and jump in – presale ends in 5 days, tick-tock. ⏳

But hurry, before the bot snorts up all the good ones!

Solana ($SOL) – From Jokey Memes to Billionaire Treasuries, Because Even Crypto Needs a Glow-Up ✨

Solana’s been Bitcoin and Ethereum‘s awkward cousin forever – overlooked, underappreciated. But this year? It’s strutting like a peacock on steroids.

$SOL’s up 30% YTD, bouncing back 3.5% post-dip. Institutional love? Nine treasuries hoarding $2.7B in $SOL – not Strategy’s $71.8B Bitcoin stash, but hey, progress toward world domination.

So, Solana’s prime pick for best crypto buys as the market balloons. 😉

If they keep Bitcoin company, BlackRock could be the tokenization evangelist we didn’t ask for. And if so, $HYPER, $SNORT, and $SOL might just moon – or not, who knows with this circus? 🎪

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Crypto Carnage: Fed’s “Hawkish Cut” Leaves Bitcoin in Tatters 🎢💸

2025-10-15 17:55