In the waning hours of an August evening, beneath the great, indifferent turning of the cosmos-and a dozen LED ticker boards-an analyst by the name of Juan Villaverde, in a mood not unlike a gambler at the close of play, posted his reflections upon the fate of the world’s most speculative asset. It was not love, nor war, nor the price of bread that moved him, but the eternal riddle of Bitcoin’s price: a problem many chase, and few solve, save perhaps a lucky village idiot or banker with a properly-aligned mustache.

Villaverde, as recounted in the curious chronicles of Weiss Crypto-surely a name for future generations to ponder-declared with some ceremony that there exists an “overlooked asset class,” an instrument so ignored by the lustful legions of crypto devotees that its quiet meanderings could foretell the storms ahead. Not the market’s thunderous now, but the silent murmurings six moons out, enough time to pen a novel, lose a fortune, or buy back in at twice the price. He claimed-between dispatches of “X” threads and the sips of strong, calculating coffee-that his private calculations revealed a market signal as ancient as greed itself, but cloaked in obscurity even Satoshi would envy.

If Dostoevsky Charted Gold’s Miseries…🪙

“You see, people believe that Bitcoin follows the course of liquidity as if it were a child, always wandering twelve weeks behind,” opined Weiss Crypto, surely with the resigned tone of a parent whose child has eaten all the sugar. Enter Villaverde: quietly tracing the fortunes of another, quieter asset while the world gossiped about ETFs and meme coins. In the time-honored tradition of old Russian seers, he suggested this mysterious gauge leads Bitcoin by a half-year, like a dog pulling its master to the next fateful pothole.

Arguments live or perish by the weight of history, and so Villaverde armored himself with an arsenal of charts scrolling back to the primordial ooze of modern crypto. “Look to December 2018,” he insisted with a zeal usually reserved for prophets or men selling miracle beard oil. There, among the cold embers of the market, his “secret” signal had burned lower first-proof, at least to Villaverde, that destiny leaves breadcrumbs for the patient or the obsessive.

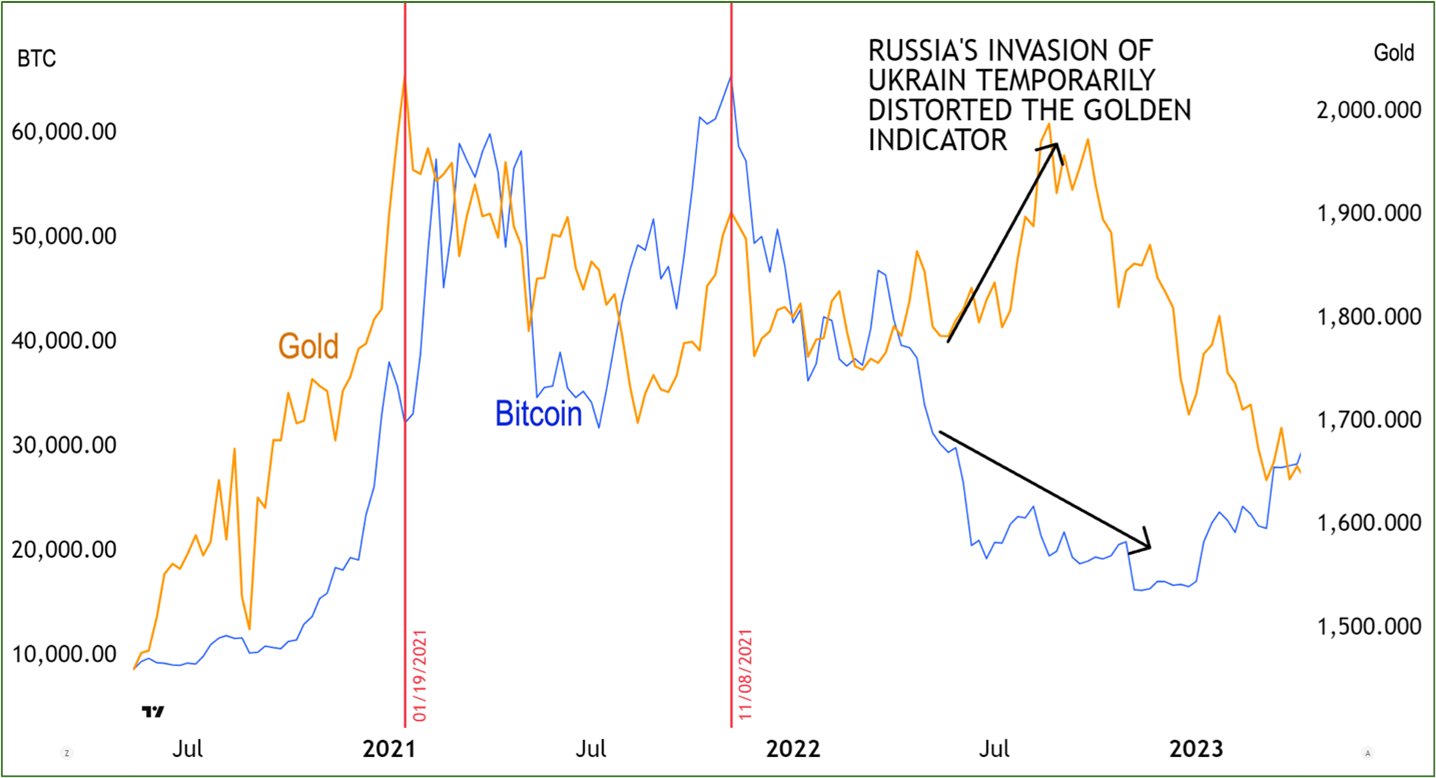

So the pattern continued: highs that refused to climb, omens missed by the multitude, a top in November 2021 ignored by all except, perhaps, a particularly insightful housecat. The masses, unseeing, marched straight into the 2022 bear-blissfully unaware, as always, that every summer is followed by a Siberian winter.

Of course, models are not immune to disorder, any more than peasants are spared taxes. The great exception-like a meteor falling upon your carefully constructed haystack-was the chaos unleashed by the Russia-Ukraine war. For a time, correlations fled like serfs before an unruly landlord, but, insists Villaverde, the old order returned when the dust and panic settled, as if the market’s spirit had simply paused for a long, dramatic sigh.

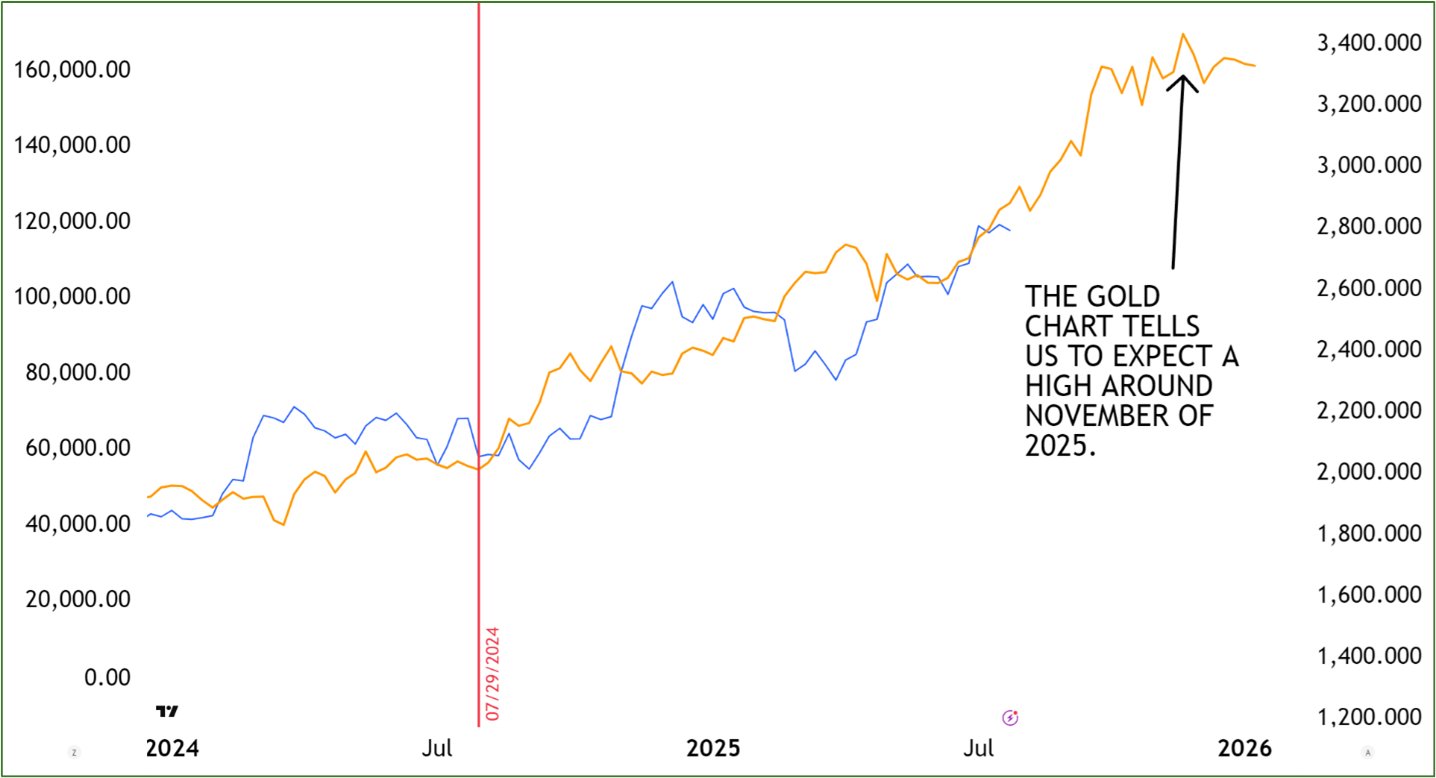

And so we reach the present: a time when BTC hovers at $114,522-a sum that would have startled even the most avaricious of 19th-century merchants, more accustomed to counting potatoes than digital coins. Villaverde’s latest augury? That his signal predicts a grand top in November 2025, as if the entire world allegorically stops for an inconvenient existential crisis right before Christmas. Should this “benchmark asset” (which might or might not be gold-he won’t say, the tease) dare to climb above its April summit, Bitcoin could stagger on into 2026 like a bear waking from hibernation to find winter still with us. Or, should it falter, we may be forced to endure yet another bear market-a fate darker than a Tolstoyan subplot.

Beyond the turns themselves, Villaverde argues-the way a philosopher soberly explains the weight of souls-it is the size of the changes that reveals the depth of market madness. “Not the direction alone,” he insisted slyly, “but the amplitude of those turns.” If nothing else, this gives hope to those forever oscillating between fear and greed: whatever comes, it shall not come quietly, nor, perhaps, mercifully.

Should you wish to weep, sell, or compose a long treatise on human folly: at press time, BTC remains stubborn as a Russian winter, unmoved at $114,522. Who can say what fortune, or folly, November will bring? One thing, at least, is certain-no one, not even Juan, can exit the market with their dignity entirely intact. 😉

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- CNY JPY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- STX PREDICTION. STX cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- 🐳 Crypto Whales Beware: Phishing Plunge Masks Sinister Shift! 🕵️♂️

2025-08-05 17:14