BNB to the Moon? 🚀 (Maybe?)

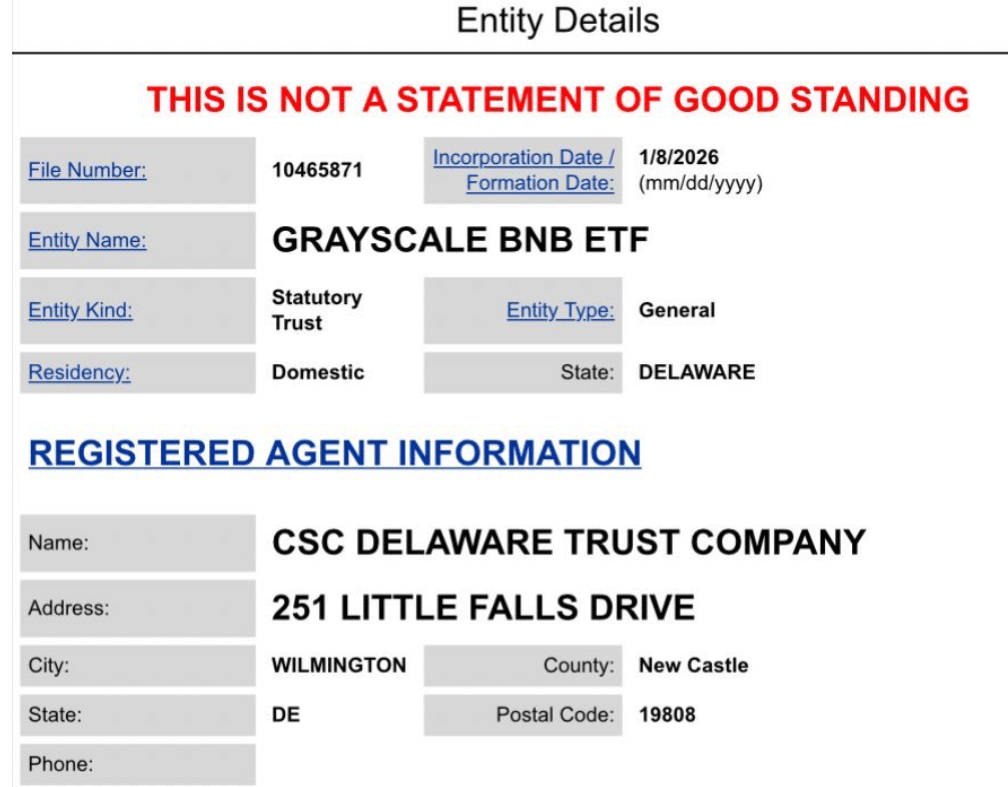

So, Grayscale has registered a statutory trust in Delaware. A very official-sounding thing, isn’t it? It preceded a formal application to the US Securities and Exchange Commission (SEC). A preliminary move, they call it. As if anything involving cryptocurrency isn’t already a bit… preliminary. VanEck, poor souls, are attempting the same. A veritable stampede towards the BNB pot of gold.