Bitcoin’s $111K: The Floor, the Ceiling, and the Oh-My-God CPI Crisis! 😱

Bitcoin [BTC] looks like it’s laying down roots, hoping nobody notices if they’re fake.

Bitcoin [BTC] looks like it’s laying down roots, hoping nobody notices if they’re fake.

Metaplanet, prancing proudly upon the Tokyo Stock Exchange, stakes its claim as the very first public company to announce its devotion to Bitcoin, treating it as a veritable treasure chest. Only recently, this titan scooped up a lavish 136 BTC for a princely sum of $15.2 million, thus boosting its collection to an awe-inspiring total of 20,136 BTC. Bravo! They now reign as the sixth-largest publicly traded company globally, based on this shiny digital currency. Who said one could not become fabulously wealthy by investing in a mere apparition of currency? 🎩✨

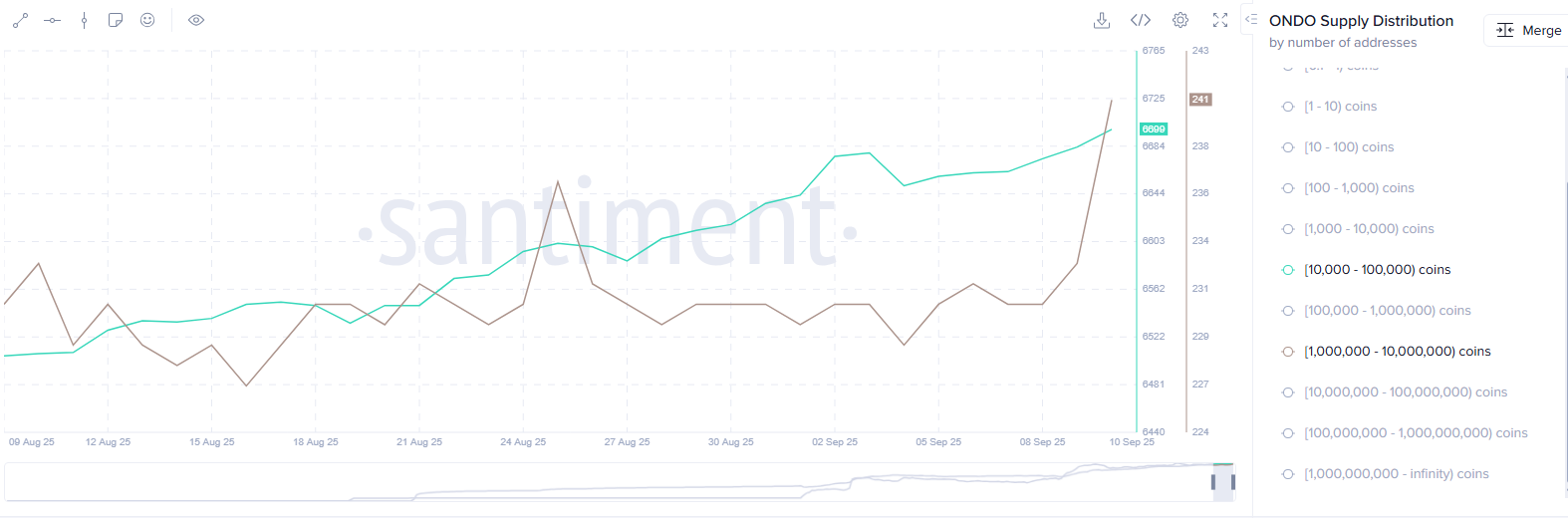

According to the scrolls of crypto.news (quelle surprise!), Ondo (ONDO) rose over 12% to reach an intraday high of $1.06. Alas, it settled at $1.01, still nursing a 9% wound from its August peak. Yet fear not, dear audience, for there is hope! Today’s rally stems from the swelling coffers of Ondo Network, whose total value locked has surpassed $1.5 billion. Ah, but what caused such fortune? Behold: the launch of Ondo Global Markets, a platform for tokenizing U.S. stocks and ETFs. In but a week, it amassed over $105 million in TVL, becoming the belle of the ball among tokenized stock platforms. 💃

Asset prices mirrored a remarkably cheerful mood on Wednesday, with Bitcoin reclaiming the $112,000 mark and European stocks opening in the green, as analysts increasingly dismissed fears of stagflation and recession sparked by the dismal U.S. jobs data. 🎉

Metaplanet (3350), the proud owners of the largest Japanese bitcoin treasure chest, are now trying to fatten their hoard by raising approximately 204.1 billion yen in an international share extravaganza. Because why just have treasure when you can have treasure *and* loads of investors clutching shares like they’re going out of fashion?

Oh, Stellar (XLM), you’re giving us all the drama of a Bridgerton ball! 🕺 According to crypto whisperer Ali Martinez, XLM’s 12-hour chart is serving up an inverse head and shoulders pattern-left shoulder in January-February, head in April-May (awkward!), and right shoulder strutting since August. The neckline? A cool $0.50. Break that, and we’re eyeing $1 like it’s the last cupcake at a party. 🧁

Today, one may acquire a shining new iPhone for less than a single Bitcoin, prompting the philosopher in me to ask: how many XRP, those sprightly tokens of the digital marketplace, must one part with to claim this coveted toy?

According to a Tuesday filing (because Tuesdays are for drama), Figure’s offering 26.6 million shares of Class A common stock at a price range of $20 to $22 per share. That’s up from $18 to $20, because why not? Selling stockholders are chipping in another 4.85 million shares, bringing the total to 31.5 million. Underwriters have a 4.7 million-share overallotment option, just in case they want to join the fun. If they do, we’re looking at a cool $796 million. 💰

Now, some folks might see a heap of Ether unstaked and start hollerin’ ’bout bearish indicators, but Sassano’s here to tell ’em to cool their jets. The ETH exit queue’s sittin’ pretty at 1,628,074, and with 35.5 million ETH staked (that’s nearly 30% of the whole kit and caboodle), it’s clear this ain’t no stampede. Just a bit of rearrangin’ chairs on the blockchain Titanic. 🚢💨

One hears whispers-nay, shouts-from the fashion houses and the pop culture clowns that orange is *the* color of 2025. As though anyone cares what those arbiters of fleeting trends dictate! But Apple, being Apple, follows the whims like a loyal puppy to its master. Such originality!