Ah, XRP, the fourth-largest cryptocurrency by market cap, has decided to grace 2026 with a flourish worthy of a Turgenev protagonist. In a mere six days, it has ascended nearly 30% from its humble perch at $1.78, and today alone, it surged close to 13%, trading around $2.40. Such audacity! 📈

But what, pray tell, has stirred this sudden bullish fervor in XRP? Let us, with the curiosity of a Russian novelist peering into the soul of a troubled serf, investigate.

Spot XRP ETFs: The Heroic Tale of Record Volumes

One must attribute much of this rally to the surge in spot XRP ETF inflows. On January 6, 2026, these ETFs recorded around $46 million in net inflows-their highest single-day inflow since their inception, led by the trifecta of Franklin Templeton, Bitwise, and Canary Capital. 🏦

A day earlier, total trading volume across U.S. spot XRP ETFs peaked at $64 million. Even more impressively, cumulative ETF inflows since November 2025 have now reached $1.23 billion, with not a single outflow day. Steady institutional demand indeed-like a Tolstoyan aristocrat with a penchant for consistency.

Geopolitical Tensions: Maduro’s Misadventures

Ah, geopolitics, the eternal spice of life. Recently, the U.S. military undertook an operation to capture Venezuelan President Nicolas Maduro, sparking tensions that would make even Dostoevsky blush. 🌍

Amidst the ensuing uncertainty, investors flocked to risk assets, improving market sentiment across the board-cryptocurrencies included. And so, like a phoenix rising from the ashes of geopolitical chaos, XRP soared nearly 30%. Who knew Maduro could be so bullish?

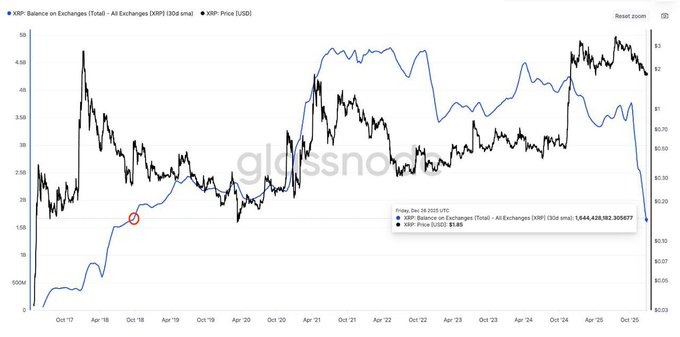

XRP Supply Tightens: A Tale of Vanishing Tokens

According to Glassnode (the oracle of blockchain analytics), XRP balances on exchanges have plummeted sharply over the past 90 days. Reserves fell from roughly 3.95 billion XRP to about 1.6 billion XRP-pushing available supply to its lowest level in eight years. 📉

Fewer tokens on exchanges mean fewer available for immediate selling. While this does not guarantee higher prices, it can fuel rallies when demand rises-and rise it has, like a Russian winter storm.

Capital Rotation: Bitcoin to Altcoins

As XRP began its ascent, traders noticed a broader market shift. XRP, often seen as the “canary in the coal mine” during altcoin rallies, signaled that capital was moving away from Bitcoin and into altcoins. 🐦➡️💎

Historically, when XRP rises sharply, it has heralded such rotations. With robust ETF demand, shrinking exchange supplies, and fresh capital flowing into risk assets, XRP’s strong start to 2026 appears to be more than a fleeting spark.

XRP’s Price: Eyeing the $3.40 Summit

After months of languishing like a Turgenev hero lost in existential ennui, XRP’s price is finally showing clear direction. Veteran trader Matthew Dixon notes that XRP has formed a large triangle pattern, typically signaling a correction rather than a breakdown. 📐

He identifies $2.68 as the key resistance level-a threshold XRP has struggled to breach multiple times. A daily close above $2.68 would confirm a breakout, potentially propelling XRP toward the $3.40 range. On the downside, strong buying support remains between $1.90 and $2.10, where the price has repeatedly bounced like a Dostoevsky protagonist on a bender.

Read More

- EUR PHP PREDICTION

- Brent Oil Forecast

- EUR USD PREDICTION

- EUR THB PREDICTION

- USD INR PREDICTION

- USD MYR PREDICTION

- Gold Rate Forecast

- USD JPY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- Silver Rate Forecast

2026-01-06 09:38